Lessons from the Ruble’s Dive

More on:

My thoughts on the ruble’s collapse are here. Three points to highlight in particular:

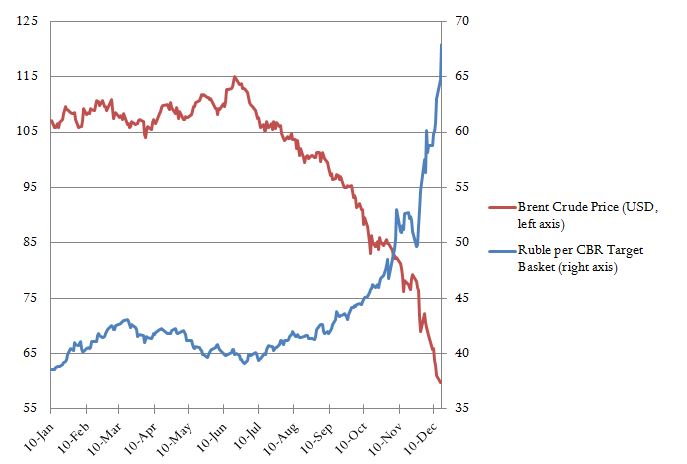

- Sanctions are a force multiplier. While oil is the dominant factor behind the ruble’s fall (see figure 1), western sanctions have taken away the usual buffers—such as foreign borrowing and expanding trade—that Russia relies on to insulate its economy from an oil shock. Over the past several months, western banks have cut their relationships and pulled back on lending, creating severe domestic market pressures. The financial system has fragmented, and any doubts that the central bank fully backs bank liabilities will lead to a run. Nonetheless, political pressures on the central bank remain intense. In fact, it was news of a central bank bailout of Rosneft that apparently triggered the most recent round of turmoil. Meanwhile, trade and investment have dropped sharply. These forces limit the capacity of the Russian economy to adjust to any shock. Perhaps Russia could have weathered an oil shock or sanctions alone, but not both together.

- Analogies to 1998 are too simplistic. Conditions in Russia and the global economy were much different in 1998, as global financial markets were dealing with the legacy of the Asian financial crisis and emerging strains in major money markets, so we shouldn’t overdraw the lessons from that time. Similarly, the fact that sanctions have caused western financial institutions to pull back from Russia makes the west less leveraged, less interconnected, and therefore less vulnerable to contagion than was the case in 1998. Therefore, I am not surprised to see a modest reaction in U.S. markets so far, with the exception of energy companies that are affected by the global energy shock.

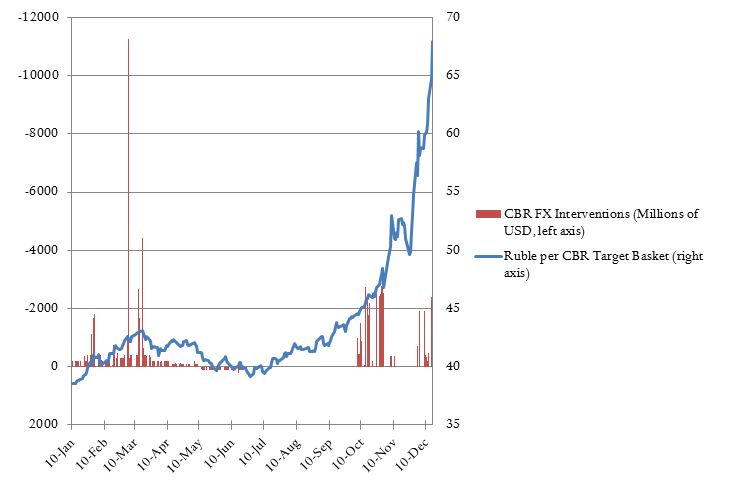

- Further rate hikes are likely to be counterproductive. The central bank has already hiked interest rates to 17 percent and intervened (see figure 2). While they have produced a bounce in the currency, the sense of panic remains. I don’t think further rate hikes are helpful in the current environment. I expect capital controls are the next step, even though the history of controls in Russia is that they are usually ineffective. Evasion is simply too easy. But Russian policymakers need to do something.

The real test of whether sanctions work starts now. I have for some time believed that it would be an upturn in inflation, and a deep recession, that would be the real test of whether sanctions would create conditions for peace, not a move in Russian stocks and bonds alone. That is because it is only now that the broader Russian public is feeling the costs of President Putin’s policies. No doubt the Russian’s searing experience with hyperinflation in 1998 still resonates with the Russian public. History also reminds us of the fragility of confidence. When crisis happens, exchange rates will move far and fast.

Figure 1: The Ruble and the Price of Crude Oil

Source: Bloomberg; Central Bank of Russia

Figure 2: The Ruble and Official Central Bank Currency Intervention*

Source: Central Bank of Russia

*Note that this figure shows only officially reported intervention by the Central Bank of Russia and does not include unreported intervention or intervention carried out by other entities, including the Ministry of Finance.

More on:

Online Store

Online Store